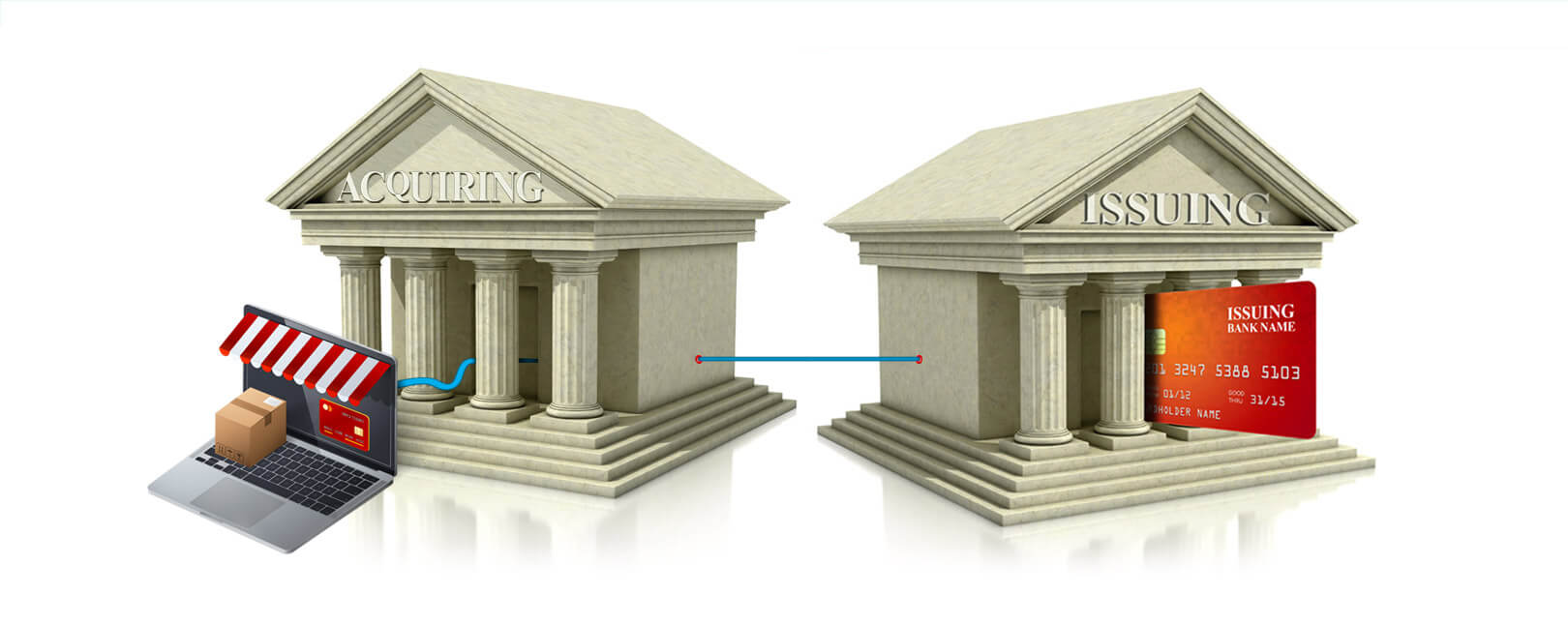

This is a rudimentary overview of the two different entities, and what function each of them serve in the course of a transaction:

Acquiring Bank

The primary purpose of an acquiring bank (also known as a merchant acquirer, or simply as an acquirer) is to facilitate payment card transactions on behalf of merchants.

In order to accept credit and debit card transactions, a merchant will need to contract with an acquirer to receive funds from the cardholder’s issuing bank.

The only alternate option would be to process payments through a wallet, like PayPal, Apple Pay, or Android Pay.

As part of the payment processing agreement, the acquirer essentially extends a line of credit to the merchant until the chargeback time limit has expired. As such, the merchant bears certain responsibilities.

The acquirer will typically hold a portion of the merchant’s funds in a merchant account reserve—a separate account held by the acquirer as a kind of security deposit. This way, acquirers insulate themselves against loss in the event that a merchant experiences excessive chargebacks.

Issuing Bank

The primary role of an issuing bank (also known simply as an issuer) is to provide payment cards to consumers on behalf of the card networks. This financial institution acts as a liaison and facilitates the repayment of transactions to merchants.

Most issuers supply cards branded by Visa or MasterCard. However, American Express and Discover are both card network and issuer, meaning they supply their own branded cards directly to consumers.

Some financial institutions, such as Bank of America, represent both merchants and cardholders, and can therefore serve as both an issuer and an acquirer at the same time.

BANK’s ROLE IN CHARGEBACKS

When a cardholder requests a chargeback, the issuing bank will forcibly reverse the transaction in question, withdrawing the money from the acquirer and returning it to the cardholder.

The merchant can choose to dispute the chargeback through a process known as representment. In this case, the acquirer will gather compelling evidence on the merchant’s behalf to prove the validity of the original transaction.

The issuer will then examine the evidence and provide an outcome, siding on behalf of either the merchant or the cardholder.