How much is one trillion? Think of it this way. One million second is 12 days, one billon second is 32 years and one trillion second 32000 years. Believe it or not the world is now in a dire economy situation. People are living in an extravagant society with the piles of debts. What is debt? Why do we live in debt? These questions were being asked many times but there are no solutions has been made until today. Why? Simply because of the conspiracy. Debt is defined as an amount of money borrowed by one party from another and the borrowing party gets permission to borrow money under the condition that it must be paid back at a later date, usually with interest. In the world today we see central banks are printing money. So here is a question, we are told from young age that money is hard to come by and we should study to work our whole life to earn it. So how then all this money suddenly come from nowhere? How is money created who is going to pay it back?

Let’s seat some history class before we explore the insanity of debt. The first form of money is the one created by government in practice it is outsourced to the central bank but controlled by the government. Government created physical money in papers and coins to meet the obligations of private banks for ATM to dispense cash during withdrawal. This physical money is a tiny fraction of economy which only stand up to 3-8% while the rest are debt-based money.

The vast amount of money created today is done by the private banking sector. In most developed economies about 97% of the entire money supply is created digitally by banks. Therefore, most money in the world is privatized. Banks invented digital money when they managed to persuade lawmakers after many early bank runs. A bank runs is an event where depositors try to get their money out all at once but the bank don’t have it. From this event banks argued that they should be legally allowed to create more deposits than actually exist based upon debt.

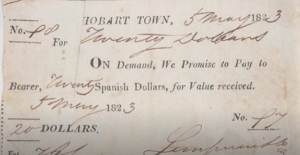

The idea of using debt as money begin much earlier before bank runs event. English innovators set the stage for banks to become the creators of money across the globe. In 1704 the English passed the promissory notes Act.

Looking at the image, you are seeing a promissory note and, in this case, it is a written promise to say that you will pay back the 20 dollars you borrowed. Under the law this piece of paper was as good as 20 dollars notes. Today we digitized this agreement and call it debt. So, when people say debt, you may think of the piece of paper (promissory note) and remembering that it is as good as money.

Banks will authorize to be able to use these debt notes to circulate as money and from this point banks were free to create and destroy debt and hence money from themselves rented at interest. In the modern world as you will see the whole world’s economy is based upon these promises.

When you go to bank to borrow some money, the banking license gives that bank the ability to create money every time they issue a loan. They do this through the double accounting system. For example, if you buy a RM500,000 house the bank creates RM500,000 in their account and you will have RM500,000 in debt that will promise to pay it back with interest. This RM500,000 debt can enter the wider economic system because when you purchased the house, the owner of that house can use that fresh debt that was created by the bank to buy other things in economy. This mean in our current system if we want to have more growth, we need more debt. The key point here is debt=money just from a different point of view.

In a nut shell, this is the reason why debt is invulnerable because the entire banking system is unable to get rid of this powerful tool to make profit. Meanwhile, remember banks are creating 97% of all money as debt and if this cant be paid back it can cause a systemic failure a risk of collapse of the entire global monetary system.