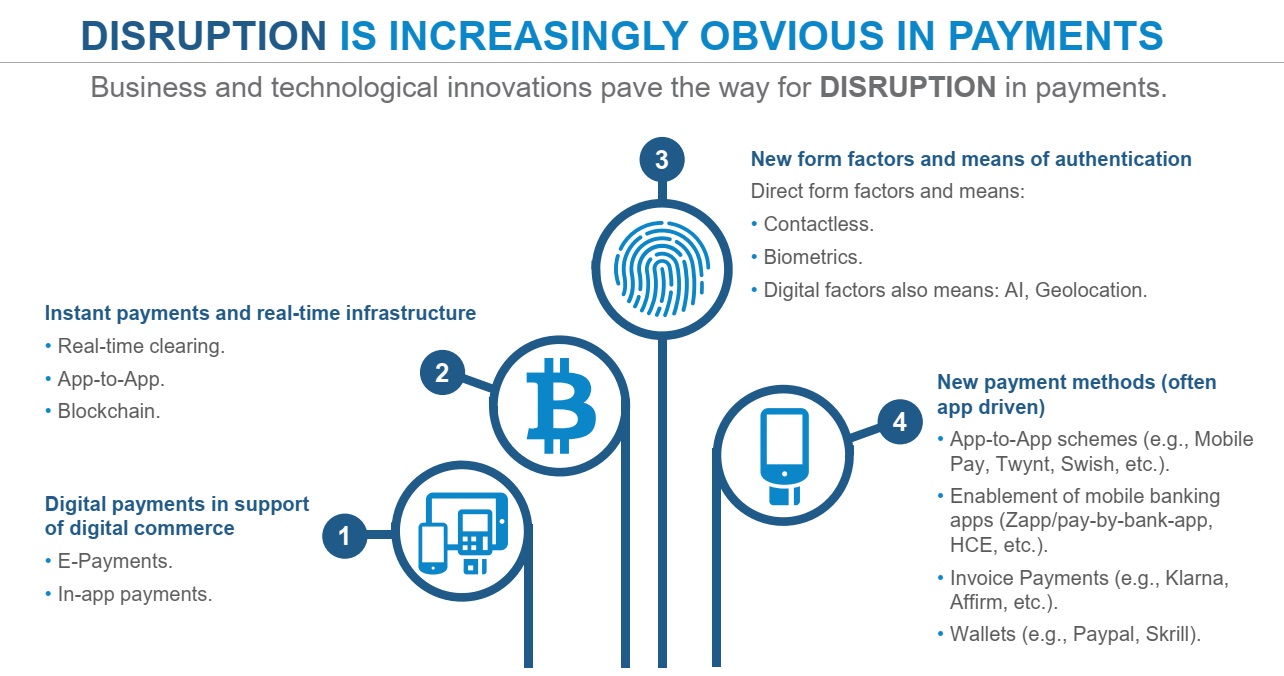

The payments industry has recently seen the entry of diverse FinTech players, both technology giants like Facebook and start-ups that are

presenting increased competition for banks, processors and networks. While start-ups have generally not been a major threat to the payments industry in the past, the prominence of smartphones as a channel, rapidly evolving customer expectations and real-time account to

account transfers will have a profound disrupting effect.

The payment processing industry is currently going through a wave of infrastructure modernization that is required to compete effectively with FinTech innovators and address evolving customer needs as well as regulatory demands. This digital revolution will extend well beyond

consumer payments and cards causing significant changes in all areas of finance. Overall, ACI expects there will be a rebalancing of revenue

sources, and more importantly, new rounds of consolidation, partnerships and innovation which will reshape the global payments landscape for the better.

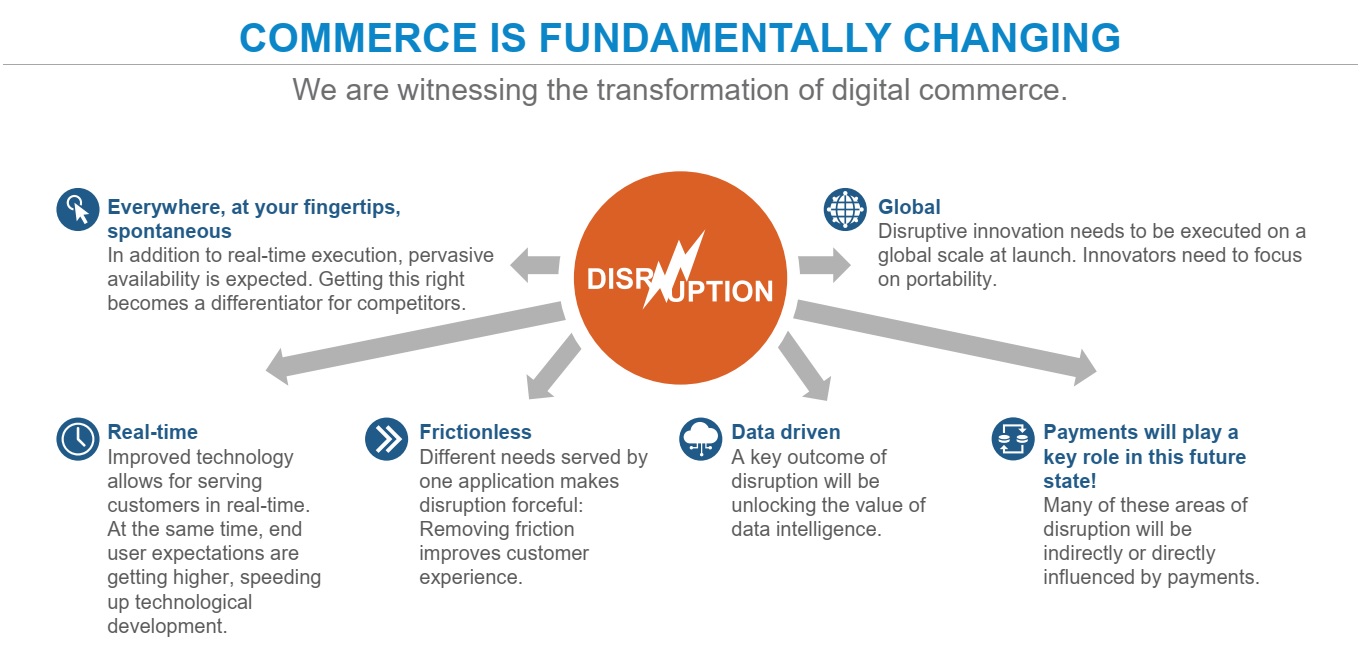

The way in which we interact, socialize, and transact is being disrupted by new technologies, new products, and innovative businesses. Payments, due to their nature, are being impacted more slowly than other industries, but disruption is clearly visible and will accelerate. The payments marketplace will look fundamentally different a decade from now – new form factors, real-time infrastructure, greater levels of integration with social and commerce, among other aspects. Disruption can be foreseen and managed. By embracing openness, driving organizational agility, and making smart bets in technology, disruption can and will be positive to the winners in the payments marketplace.