In the domestic economy, the strength of the national currency is calculated as the purchasing power when buying locally produced goods and services. It is based on income and wages reports which reveal the nominal earnings of the citizens.

The nominal income value is then adjusted to the inflation rate of the observed period to find the real income value. The real income figure represents the true economic value of the income amount in the pre-inflation economic conditions.

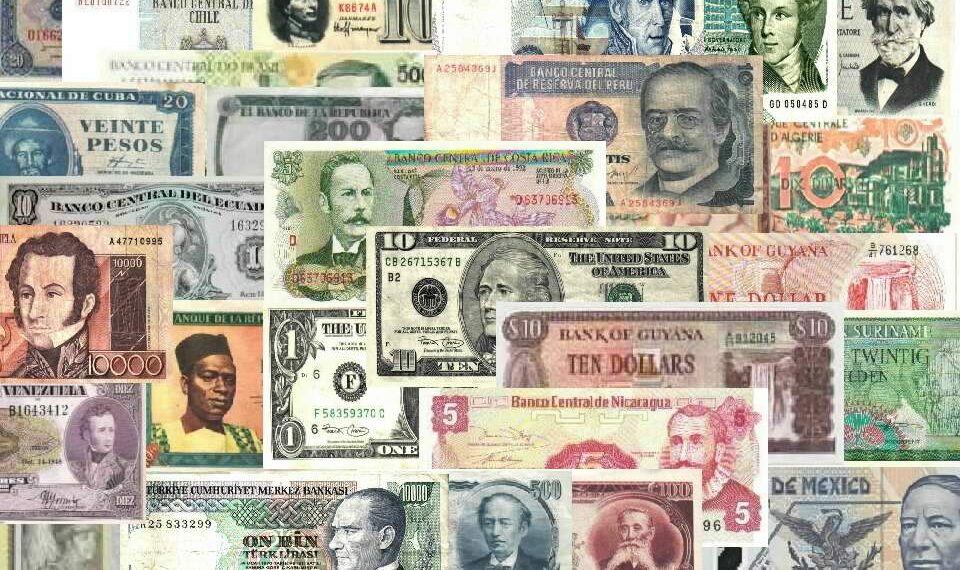

In the foreign exchange markets, a currency’s strength is measured in relation to foreign currencies in the Forex currency pairs. For example, EUR/USD currency pair is comprised of the U.S. Dollar and the Euro, the two largest reserve currencies in the world.

Their competition depicts the global economy’s preference and trust towards their respective economies. A variety of factors can affect the FX rate of the Euro-Dollar, including their internal economic climates, trade performances, and regional conditions.

On the other hand, when it comes to the currencies of the emerging markets like Brazil or China, their strength is measured against one of the major reserve currencies. For example, when the Chinese Yuan increases against the U.S. Dollar in the USD/CNY currency pair, the Chinese economy would be getting stronger and gaining more power in the global arena.

There are also currency strength indicators which gauge the overall strength of a currency in the global financial markets. Notably the US Dollar Index (“Dixie”) is the most popular currency strength meter and has a tradeable derivative ETF in the Intercontinental Exchange (ICE: DXY).