The basic theory is that when the domestic stock market rises, it gives investor confidence that the country’s economy is also rising, leading to increased interest from foreign investors and demand for the domestic currency. Conversely, if the stock market underperforms, confidence falters and foreign investors take their funds back to their own currencies.

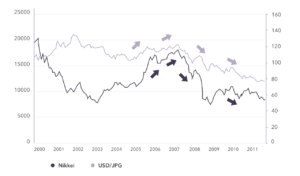

There have been cases where this appears to be true, when the performance of a stock market impacts the price of a currency pair. For example, the Nikkei stock exchange in Japan has historically exhibited an inverse relationship with the USD/JPY currency pair, meaning a rally in the Nikkei would often lead to a strengthening of the yen against the dollar. This was because investors saw such a rally as a sign that the Japanese economy was gaining momentum and would pull their money out of the US dollar to put back into the yen. The increase in the price of the yen would cause the USD/JPY pair to decline as the dollar weakened relative to the yen.

Many traders began to see the Nikkei index as an indicator for the future of the USD/JPY pair – buying USD/JPY when the Japanese economy appeared weak and selling USD/JPY when the Japanese stock market showed signs of strength.

However, in reality the relationship between the Nikkei and USD/JPY is more complicated. When the 2008 global financial crisis hit markets, the correlation completely changed to become positively linked, with the stock market moving in the same direction as the currency pair. This change has largely been attributed to a change in market sentiment, as investors began to look at the yen more positively after the crisis.

The changing correlation shows us that there is no perfect science to the relationship between stocks and forex. This doesn’t mean that there is no relationship between the two markets, or that the relationship is useless, it merely demonstrates that it is important for traders to look at a wide variety of indicators before deciding how to trade.

One explanation of the relationship between exchange rates and stock prices is the ‘portfolio balance approach’, which advocates that the causality runs from exchange rate to stock prices. It is based on the idea that the market value of firms can be significantly affected by the health of the national currency. It suggests that when a country’s currency is weakened, its exported goods become cheaper internationally, which can help to fuel growth and lead to a potential increase in profits for companies whose earnings are export based.

A popular example of the correlation between forex and shares is the FTSE 100 stock index and British pound sterling. The index is impacted by the direction of the national currency because a lot of the listed companies have international operations, so a large portion of their profits are made in US dollars or other currencies. If sterling weakens then the dollar revenues are worth more and the FTSE 100 is likely to rise as the companies on the index become more valuable.

Although no definitive relationship has been proven, there are plenty of correlations that have piqued traders’ interests over the years. As both forex and stocks have a crucial role in business all over the world, it is likely that academics and analysts will continue to try and understand the relationship between exchange rates and share prices.

While looking at specific examples can be a great way to see the two markets interact with each other, it is important to remember that there is no guarantee these patterns will be repeated over time. Using a single data point, especially one as prone to change as the relationship between forex and stocks, can be extremely risky. Traders and investors should consider multiple indicators when they are making decisions about what to trade and when to trade it. The forex market can be an interesting factor to consider when looking at stocks, but alone it is not enough to provide an accurate assessment of market movements, and vice versa.