FinTech is undeniably one of the most promising industries in current time. Find out the most mentioned topics and what you ought to not miss.

The Blockchain Technology

It is only a be counted of time before the broader financial services and banking industries shift to blockchain and network-based approaches. Blockchain, as a pure platform technology, will maybe in a position to cut out the middlemen (or middle companies) everywhere. Because of that, many fintech entrepreneurs and specialists constantly discuss matters such as: What does Blockchain matter? What are the various Blockchain standards – sidechains, hyperledger, public or private blockchain? Who are the primary players? What are they constructing or what sectors are they targeting? What is the investors’ point of view on blockchain startups? What are the latest amazing blockchain startups?

It’s time to become part of the digital revolution and be a part of the network and platform-emerging world.

Digital Finance and Commerce & Digital Payments

After affecting all sectors of commerce, the digital revolution has now hit the financial sector, a sector that is protected by means of a specific regulatory environment. From vital peer-to-peer transfers to savings, loans and credit score to merchandise that leverage social media, eCommerce and smartphone penetration, the transformation has been shifting forward extensively for the past years. Additionally, developments in digital technological know-how continued to structure the payments industry in 2016 as mobile, online and other digital forms of digital payments moved.

Lending

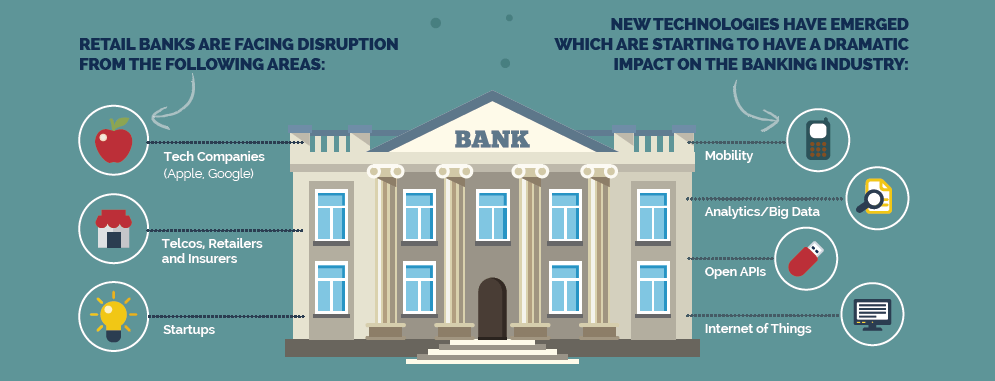

Alternative lending models are transforming the banking sector, creating both aggressive threats and evolutionary opportunities for financial institutions in Asia. But with an estimated 4,000 corporations challenging banks in each and every product line, the degree of disruption dealing with the financial industry has reached a tipping point, as this infographic shows:

Banks and FinTechs have strengths that are complementary and which have to be leveraged to create a enhanced central financial experience for customers. While FinTechs excel in agility, innovation and exploiting new technology, banks offer capital, deep consumer bases and expertise in working with regulators.

Customer’s banking experience

Customer experience is of paramount importance in all industries. A new mobile generation of consumers, the rise of direct pay and on-line financial services, and an amplify in banking service fees all contribute to an on-going shift in how banking groups service their customers. In order to optimize its customer experience, a banking organisation need to understand the desires and behaviors of its customers. A wonderful and trouble-free customer experience can end result in increased customer satisfaction, loyalty, advocacy and higher customer lifetime value.