Ever considering the fact that Hong Kong issued eight virtual banking licenses first half of 2019, regulators around Asia are clamoring to come up with their own framework to facilitate this new breed of banks.

While Hong Kong has reinvigorated Asia’s interest in virtual banks, one of the earliest situations of virtual banks was actually formed in Japan in 1999. Sakura Bank (now known as Sumitomo Banking Corporation) led a consortium consisting of Tokyo Electric Power Co., Fujitsu Ltd. and NTT DoCoMo Inc to structure Japan Net Bank.

Though Japan Net Bank was among the first in this space, many of the aspirants from South East Asia looks to be a whole lot greater in the mould of European neo-banks like Monzo and Starling Bank which normally started out their experience through issuing payments card paired with a digital wallet.

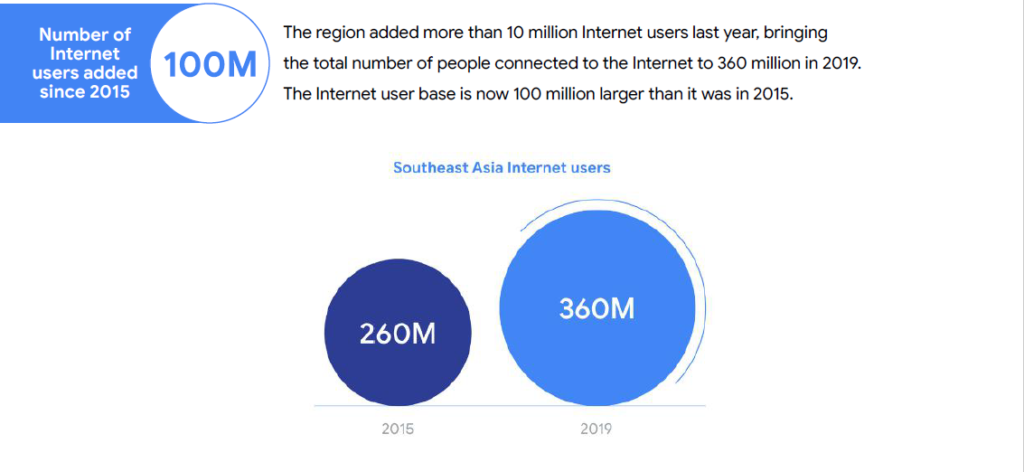

Being domestic to a massively unbanked population of 196 million and 324 million mobile net users, paving the way for this new breed of banks couldn’t come at a extra crucial time for South East Asia.

Whether it is imparting monetary services to the under-served, or developing new digital choices to an an increasing number of internet-savvy population, many incumbent banks are struggling to fulfill that need.

These circumstances led to an explosion of digital wallet players trying to service this need. In Malaysia alone, we’ve discovered over 40 digital wallet operators catering to a population of simply over 30 million.

With the market getting saturated and with increasingly thinner margins for the players, it is no surprise that many of these operators are looking to virtual banking in hopes to gain new income sources.

After all, if you look at a typical bank’s revenue profile, only 7% of its revenue comes from payments. Interests from lending for SMEs and customers characterize a lot large element of their profits.

Recent funding offers have additionally shown that the section of B2B fintech structures is becoming increasingly relevant.

A substantial range of current players like WeBank, WeLab, and Judo Bank are all eyeing the SME market and we anticipate that when markets like Singapore and Malaysia open their doorways to virtual banks, an exquisite quantity of players may additionally do the same.

While the prospects of building a virtual bank can clearly be attractive to many fintech operators, it is not an convenient path to undertake. For traditional players, digital transformation requires vast investment in new technology, whilst monetary returns aren’t usually apparent in the short term.

For the new fintech players, key challenges are associated with creating new capabilities from scratch, staying within the regulatory and compliance boundaries, and keeping a lean engineering team.

These new capabilities: white-label digital card issuing, digitally-enabled cross-border remittances, as nicely as developing interoperable ecosystems linked to digital wallets and real-time fee systems, – appear to be in line with the most advanced modern Fintech trends. So for Virtual Banks, partnerships with businesses like global fintech organization ought to be an efficient way to create an end-to-end digital banking experience.

The long-term have an impact on of such partnerships may want to be profound. Such new and innovative systems will even the playing discipline for the disruptors and traditional institutions alike, accelerating change in the enormously regular banking industry, while creating a a whole lot greater inclusive environment for building new services.

But the ultimate winner in this game will be the consumer.