Contents

General Knowledge

Oil is a commodity, and as such, it tends to see larger fluctuations in price than more stable investments, such as stocks and bonds. There are several influences on oil price. OPEC Influences Prices OPEC, or the Organization of Petroleum Exporting Countries, is the main influencer of fluctuations in oil

What Is a Store Of Value? A store of value is an asset, commodity, or currency that maintains its value without depreciating. A store of value is essentially an asset, commodity, or currency that can be saved, retrieved, and exchanged in the future without deteriorating in value. In other words,

A gold fund is a type of investment fund that holds assets related to gold. The two most common types of gold funds are those holding physical gold bullion, gold futures contracts, or gold mining companies. Gold funds are popular investment vehicles among investors who wish to hedge against perceived

What Is the London Metal Exchange (LME)? The London Metal Exchange (LME) is a commodities exchange that deals in metals futures and options. The LME is a non-ferrous exchange, meaning the exchange does not trade iron and steel. Instead, tradable contracts include aluminum, copper, gold, silver, cobalt, and zinc. Located in

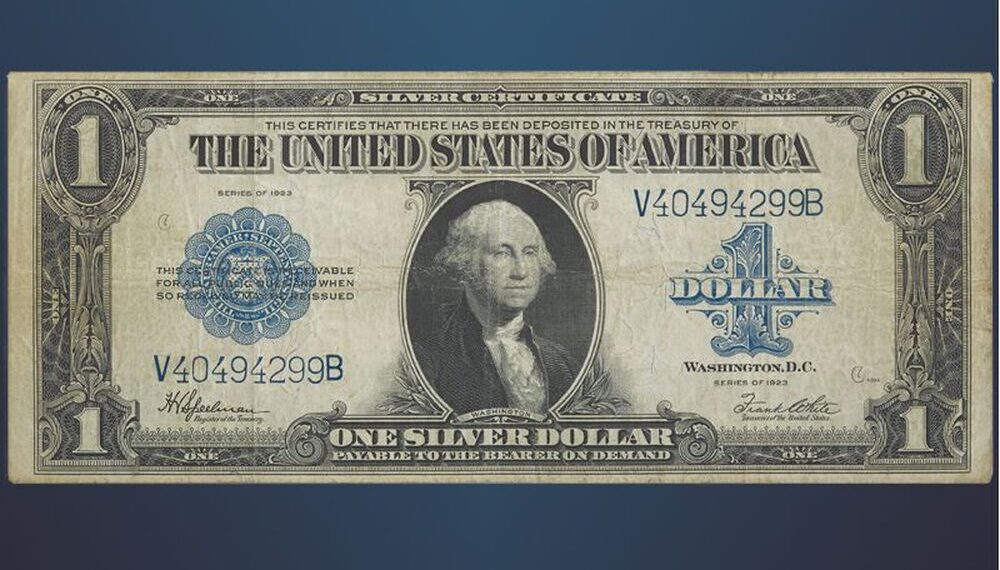

What Is a Silver Certificate? A silver certificate is a type of legal tender in the form of paper currency that was issued by the U.S. government beginning in 1878. These certificates were eventually phased out in 1964 and today can be redeemed for their face value in cash only,

The most obvious advantage of index funds is that they have consistently beaten other types of funds in terms of total return. One major reason is that they generally have much lower management fees than other funds because they are passively managed. Instead of having a manager actively trading, and

An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index, with the goal of matching the performance of that benchmark as closely as possible. The S&P 500 is perhaps the most well-known index,

What is Cross Hedge? Cross hedging refers to the practice of hedging risk using two distinct assets with positively correlated price movements. The investor takes opposing positions in each investment in an attempt to reduce the risk of holding just one of the securities. Because cross hedging relies on assets

What Are Commodities? Do you ever think about what goes into that cup of coffee you reach for every morning? What about the gas that you use to fill up your tank every week? Most of us never realize it, but virtually all of the goods begin with commodities. Commodities

What Is Small Cap? The term small-cap describes companies with a relatively small market capitalization. A company’s market capitalization is the market value of its outstanding shares. The definition for small-cap varies, but generally means a company with $300 million to $2 billion in market capitalization. Understanding Small Cap The “cap” in small-cap

Recent Posts

Recent Comments

- Cacey Taylor on Forex vs Stock Trading

- A WordPress Commenter on Hello world!

- John Doe on Which is the Best PC for Photo Editing?

- John Doe on Giant Cruise Ships

- John Doe on 50 Most Beautiful Places in the World

Categories

- Articles/FAQ

- Blockchain

- Cash/Voucher/Card based

- Commodity

- Credit Card

- Cryptocurrency

- cyber security

- Digitization

- e-Payment

- e-Wallet

- Fintech

- Forex

- Fraud

- hacking

- High risk

- Investment

- Mobile Payment

- News

- Payment Gateway

- Scam

- Security

- Shipping Methods

- Stock

- Technology

- Travel

- Troubleshooting

- Uncategorized

Latest Posts

- January 22, 2021

- January 22, 2021

- January 22, 2021

- January 12, 2021

- January 12, 2021

Newsletter