Candlestick charts are arguably the oldest type of charts used for price prediction and it all started in the 1700s when Homma Munehisa in Japan became a legendary rice merchant for predicting rice prices using Candlestick Charts. Candlestick chart patterns are exceedingly popular in Forex trading because of their dynamic features and versatility.

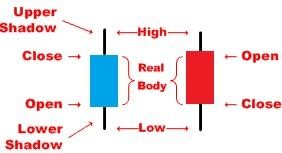

Each candle consists of two parts: the body and the shadows. The body reflects the open and closing prices for a certain period. If the candle body is dark, the close price is below the open. If the candle body is light, the close is higher than the open for the period. On the other hand, candlestick shadows reflect the intra-period high and low prices of Forex in a market.

Each element in a candlestick pattern predicts certain trends. Long white candlesticks predict strong buying pressure. The longer the white candlestick, the further the close is above the open. This shows that prices moved significantly from open to close and Forex buyers were more than willing to accept above-average risk in pursuit of above-average returns.

There are various patterns of candlesticks charts used in Forex trading. The Doji candlestick pattern, for example, is a candlesticks pattern that is generated when the body of the candlestick is marginal as a market’s open and close prices are almost the same. There are others patterns, such as Shooting Star, Hammer, Inverted Hammer, Gravestone, 3 White Soldiers, 3 Black Crows, Marubozu White/Black, and many more.

The major advantage candlesticks chart patterns are that they provide investors with an easy-to-read system with which to view any changes that might occur in supply and demand. Simply by using candlestick chart patterns to perform critical day analysis, investors can find evidence of any trend reversals in time. This serves as an advance warning to investors about how the market will move. Used in combination with other methods and with market indicators, Candlesticks can provide investors with a lot of potentials to profit in trading.