Invest in forex education

Forex buying and selling schooling is one of the quintessential components for overcoming the above-mentioned psychological impediments. With suited training, you will acquire essential competencies for making rational decisions, rather of relying on your gut feelings.

If you want to blindly enter and exit trades barring having ample motives for making the decisions, you’ll turn out to be emotional, and damage your trading capital.

You need to understand how the foreign exchange market operates and the elements that purpose its movements. For example, if an financial news record is released, you want to recognize how it is probable to affect moves in the market, instead of becoming fearful and beginning to shut and open trades haphazardly.

A perfect forex schooling will assist you in creating a method capable of generating constant profits. Trading without a worthwhile approach gives too a lot room for disaster. However, a dependable trading method will help you to relax and be calmer, as it reduces your hazard and your anxiety.

Follow your buying and selling plan

Trading with a strong layout lowers risks and assists you in keeping your emotions underneath control. Typically, a buying and selling graph consists of a set of hints and strategies for executing change decisions.

A buying and selling graph is commonly created after doing an tremendous analysis and reading the market behavior. It is what you want to keep consistency and profitability in your trading.

For example, a good trading layout ought to answer the following questions.

How many pips I goal per trade?

At what times do I trade?

How tons capital do I danger for each and every trade?

What policies must I use for coming into trades?

How must I control open trades?

What rules must I use for exiting trades?

Emotions are can spoil your manage if you let doubt and worry live freely. However, a well designed trading design will aid you to continue to be targeted and exchange profitably except being sidetracked by your intestine feelings.

Trading except a sketch will go away you at the mercy of your emotions. Consequently, you’ll be taking trades primarily based on emotions and barring making any meaningful evaluation of the market behavior.

With a plan, whenever there is a sign of trouble, you’ll no longer want to regulate your trade choices fearfully or greedily. All your alternatives to enter and exit the market will be based on your predefined set of guidelines—giving no room for any emotion to cloud your mind.

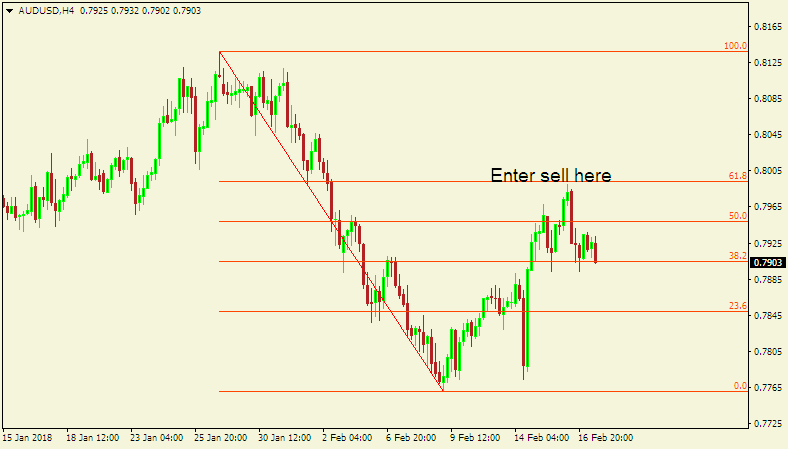

For example, if your exchange format specifies that you will be coming into retracement trades whenever the market bounces off one of the Fibonacci levels, you should stick to that rule as a good deal as possible.

Here is a 4-hour chart of the AUD/USD illustrating how you ought to follow the rule.

Practice threat management

Proper danger administration is what distinguishes a trader from a gambler. If you expose too a whole lot capital to the market due to the fact of revenge or euphoria, you could quit up with mammoth losses.

To keep away from turning into an emotional trader, do now not threat an amount of cash you cannot lose comfortably. A frequent rule of thumb is to chance solely 1% of your capital for every trade.

Apart from the usage of leverage wisely, you should also avoid fearfully transferring or ignoring stop losses and take profit targets. Emotionally managing trades will increase risks.

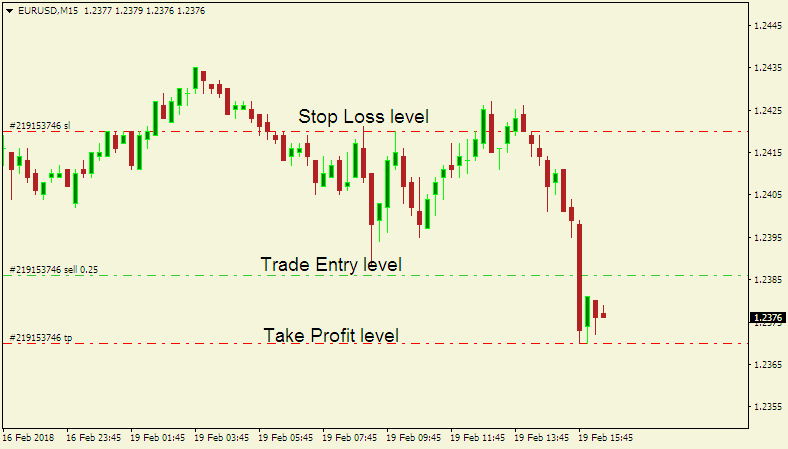

For example, right here is quick trade on the EUR/USD.

If you took the trade and saw it moving toward the goal level, widening the take profit degree too greedily may want to enlarge your danger of a reversal turning a profitable change into a loss. Before adjusting your take income level, your change layout must first limit chance through adjusting your give up loss level.

Change your mindset

An unrealistic attitude is a predominant motive of emotional trading. If you are not focused and composed in your buying and selling decisions, you will without difficulty adopt the hazardous dependancy of being fearful, greedy, revengeful, or euphoric.

You want to have a sensible mindset and grow to be an emotionally mature trader. Remember that your wish for earnings on my own will not be ample make you gather these profits. You must train your self to method the market with discipline and keep away from decisions based totally on ecstatic or different emotions.

With a clear and logical mindset, your emotions will lack enough power to manipulate your alternate decisions.

Conclusion

The psychology of forex buying and selling is an crucial issue of becoming a profitable trader. For most traders, this is what triggers the largest share of trading mistakes.

Therefore, you need to try to maintain your thoughts in check. If you fail to control them, they will definitely manipulate you—and you’ll feel sorry about the trading choices the feelings lead you into.

The success or failure of your forex trading profession relies upon on your information at doing away with feelings from buying and selling decisions, and in that information resides the alpha and omega of profitable foreign money trading.