Profit-taking is the world’s easiest career.

However, if we want to squeeze every penny from a deal, we need to trade smart.

Ideally, when you develop your account you would like to aim twice as much as you are losing, so a risk: reward ratio of 1:2.

This would significantly improve your trust in the knowledge that your trade proposals are actually likely to make twice as much as you lose, i.e. $ 800 potential benefit vs $ 400 potential loss.

These incentive rates are merely goals, which does not mean that you can close the position immediately, as most people do.

Would you like to know the great secret used by all investment banks, institutions, and hedge funds?

For as long as possible, they keep their winners free. You see, to outperform anyone else, they do not use witchcraft or voodoo. When it is time to take their positions or add more, they let the market tell them.

For as long as possible, they keep their winners free. You see, to outperform anyone else, they do not use witchcraft or voodoo. When it is time to take their positions or add more, they let the market tell them.

That being said, they do have business regions where they are searching for legitimate exit points. Even if their take profits are hit by the market, they will generally let their trade continue.

It’s one of the most common problems beginners and amateurs alike suffer which is taking profit too early because they did not know better.

Small or big profit is still a profit, as they say, but you need to let the market do the work for you to survive this game.

I will give a brief guide to distinguish you from the beginners, the amateurs, the wrong kind of profit takers and get you on the right road to long-term benefit. It is merely a guide and you can choose to use it or not.

How to start? – Capital Protection

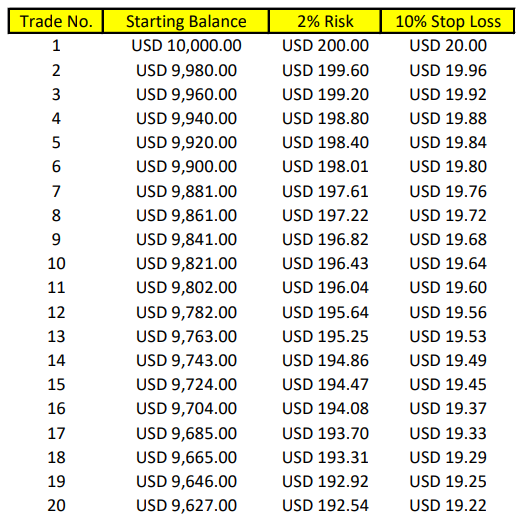

Example of calculation method,

Portfolio: $100,000.

2% Position risk per trade: $2,000

10% Risk of position: $200.

Overall, we are only taking 0.2% risk per trade.

Take a look at the table above, it’s taken 20 straight losses in a row to lose 3.73%% of the initial portfolio balance. (Note that it does not include any charges, fees or commission during trading.)

You will not be getting 100% of your trades correct most of the time. If your mindset is that you always pursue a solution and achieve profit, that needs to stop here.

As you can imagine, your underperforming days will be secured by sticking to your risk management while improving your successful trades.

How to calculate? – Profit taking

Your risk size is the first thing you must know before joining any exchange. You now have two choices:

Shift the stop loss to the same risk size after the benefit. E.g) Risking 10 pips in 10 pip intervals and changing the stop failure. This way, at your breakeven point/trade entry stage, you retain the same risk as you lock in-profit, making the first incremental.

Or

You can set the regular risk parameter, but you can decrease the risk instantly instead of shifting the stop loss in the same risk amounts and choose a different amount of pips to lock in.

For example, the typical stop loss is 50 pips, but you want to monitor the market by 25 pips until the market has shifted in your favor, which is a 50 percent risk reduction.