In order to identify market dynamics and chart patterns in the forex market, technical analysts rely on several resources and indicators. Indicators used in technical analysis are broadly divided into two, leading and lagging, respectively. Knowing the difference between the two and how they respond to price shifts is crucial to reaping rewards for technical analysis.

A leading indicator is a tool which is used to predict a demand or price trend in technical analysis. The indicators allow traders to predict ahead of time price movements. Thus the “leading” name. An efficient leading indicator would allow traders to open trades before stocks begin to shift.

Lagging Indicator

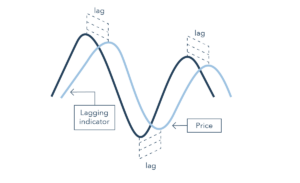

A delayed signal on price change offers a lagging indicator. Once the price has moved or is in the process, certain indicators include signals. Until joining transactions, traders use lagging indicators to validate patterns.

Difference between Leading and Lagging

How they respond to price changes is the key distinction between lagging and leading indicators. While leading indicators step ahead of price, lagging indicators lag price, indicating upcoming price changes, and only confirm price movements after they occur.

Leading indicators respond quickly to price, unlike lagging indicators, and are therefore perfect for traders looking to benefit from short-term price movements. In scalping and swing trading, indicators are widely used.

Although leading indicators forecast future price changes, they are vulnerable to false signals being issued. A leading indicator can mean that it is time to enter a trade to change direction and move in the opposite direction for price only.

Although leading indicators forecast future price changes, they are vulnerable to false signals being issued. A leading indicator can mean that it is time to enter a trade to change direction and move in the opposite direction for price only.

In reacting to price changes, lagging indicators are sluggish. Similarly, with long term trading strategies such as positional trading, such metrics perform well. Such measures offer accurate signals on long-term market changes in this case.

The biggest downside to lagging indicators is that their sluggishness frequently puts traders at considerable risk of joining trades late in the game when reacting to price changes.

Example of good Leading indicators

In technical analysis, leading indicators are commonly used as they forecast market changes before they occur, enabling traders to get ahead of important price movements.

Examples of good leading indicators are:

- Relative Strength Index

- Stochastic Indicator

- On Balance Volume

- Williams %R

Relative Strength Index

Thanks to its potential to alert traders about overbought and over-sold situations, the Relative Strength Index is widely used in technical analysis. Traders typically expect market reversals if faced with these conditions.

The RSI has readings that range from 0 to 100. Readings over 70 are correlated with conditions that are overbought. In these situations, despite the increased danger of price reversal, traders are typically wary about joining long positions.

Readings below 30 signal conditions for over-sale. Similarly, given the increased risk of market reversals and move-ups, technical traders refrain from entering short positions.

It is important to remember that prices can stay overbought and over-sold much longer when using the RSI. It is one of the main threats related to the leading indicator of the RSI.

Stochastic Oscillator

The stochastic oscillator is a momentum indicator that, in signifying overbought and over-sold conditions, works the same way as the RSI indicator. The indicator is based on the assumption that the momentum of the market shifts direction much more rapidly than volume and price.

The indicator comes with readings ranging from 0 to 100. Readings above 80 suggest conditions of overbought, whereas anything under 20 is considered oversold. Unlike RSI, Stochastic reacts to price changes much quicker.

On Balance Volume Indicator

In order to encourage traders to make market predictions, the On Balance Indicator focuses on volume. An increase in the trading volume of a given instrument will always result in a rise in the indicator, signalling a possible price spike.

A drop in volume in a specific direction will also mean fatigue, warning of a possible reversal in prices. The OBV indicator, like other leading indicators, is vulnerable to false signals, especially during market-moving events, resulting in enormous volume spikes.

Lagging Indicators

Lagging indicators are used to filter noises in the market that often give misleading signals when leading indicators are seen. They can provide reliable signals of long-term trends while filtering noise.

Below are the commonly used lagging indicators:

- Moving Average

- The MACD Indicator

- Bollinger Bands

Moving Average

A Moving Averages is a lagging predictor since it is primarily dependent on historical information;. The price increases above and below any moving average are caused by buy and sell signals.

For example, as soon as the price rises and closes above the 200-day moving average, a positional trader could enter a long position. A investor may also take advantage of this opportunity to complete any short position as the price rises and closes above the 200-day MA, which often signals the beginning of a long-term upward trend.

The fact that the moving average is slow to respond to price shifts means that, when it comes to long-term trading, they offer more reliable signals than leading indicators.

MACD

MACD but not McDonald’s. They also give rise to the moving average convergence divergence indicator if moving averages are used in pairs. Two moving averages are used in the MACD predictor, one which is fast-moving and the other slow.

MACD but not McDonald’s. They also give rise to the moving average convergence divergence indicator if moving averages are used in pairs. Two moving averages are used in the MACD predictor, one which is fast-moving and the other slow.

Similarly, it serves as a buying signal if the fast-moving average increases and passes the slow-moving average. The same signals a possible sell signal if the rapid-moving fall below the slow-moving average.

A histogram that is used to predict crossovers between the two moving averages also comes with the indicator. The histogram size represents the difference between the averages that are going. The same implies that moving averages are diverging and moving further apart as the scale increases.

Conclusion

Leading and lagging is a broad grouping of metrics used in price determination in technical research. While leading indicators react quickly to price changes and try to anticipate potential price movements, lagging indicators use historical data to slowly react to price changes, resulting in delayed feedback.

In short-term trading strategies, leading indicators are widely used where traders benefit from short-term price fluctuations. The delayed feedback from lagging indicators means that they are perfect for long-term trading strategies where market trend confirmation is crucial.