Forex sentiment refers to the typical feeling the market members have about the overall performance of a forex pair. It is a useful way of gauging the feeling or tone of the market and then making fabulous alternate decisions.

Every trader taking part in the forex market has his or her personal opinion about the direction the market is likely to take. And, the selections they make—whether to vicinity purchase or promote orders—is based totally on these views.

Ultimately, the predominant path the market is going to take is based on the combination of the opinions of all the market participants.

For example, if the dominating sentiment is bullish for a foreign money pair, it will upward push in value. Note that using sentiment analysis will no longer grant you with precise entry and exit places for each and every trade—but it will assist you to be aware of whether or not to journey with the float or not.

Certainly, you can use sentiment analysis with technical analysis and vital evaluation to siphon your alerts and improve entry and exit decisions.

Importance of Sentiment Analysis

Knowing how to use sentiment analysis can be a quintessential device in your toolbox. Sentiment forms a large issue of what drives actions in the forex market.

For example, if 90 traders have positioned purchase orders on the GBP/USD and 10 traders have positioned promote orders on the foreign money pair, it shows the sentiment to be 90% standard in favor of buy positions.

In the forex market, if merchants have a fantastic attitude on a forex pair, the sentiment can additionally be positive. On the different hand, if the attitude is poor, then the sentiment is probable to be negative.

As a trader, it must be your accountability to decide the predominant thoughts in the market. Are buyers bullish about the financial situation of a country? Are the indicators suggesting positivity for the currency?

Remember that you cannot dictate to the market what it should do. However, what you can do is make a calculated response to what is taking area in the market.

Including sentiment evaluation in your trader’s toolbox will assist you to determine whether to trip on the identical bandwagon with each person or wait for your turn.

If you figure out to omit sentiment analysis, you can also make losses. It is what you need to emerge as worthwhile in your trading.

Forex Sentiment Tools

Forex sentiment evaluation entails figuring out traders’ positions so that you can try to be aware of how they are questioning and make splendid change decisions.

In other economic markets, like the shares market, members can assess the volume traded to gauge the prevailing sentiment.

If a inventory price has been on an uptrend, but quantity is decreasing, it ought to indicate overbought market conditions.

Likewise, if a plummeting stock suddenly reversed its go because of increased volume, it ought to factor to shifting market sentiment, from bearish to bullish.

However, because forex buying and selling takes area over-the-counter, the absence of a centralized market complicates knowing the quantity of each and every forex traded.

Nonetheless, right here are two frequent equipment that foreign exchange traders can use to measure market sentiment.

- Contrarian indicators

- Commitment of Traders report

1. Contrarian indicators

The contrarian buying and selling method involves setting orders that are towards the current market sentiment. Contrarian merchants frequently vicinity lengthy orders when a foreign money is weak and short orders when it’s strong.

These merchants take gain of conditions when the market has attained a degree of saturation. If traders are propelling fees higher, it may want to result in overpriced assets. Similarly, if the market is playing a promoting spree, it ought to present opportunities to purchase at a decrease price.

Essentially, the contrarian approach posits that on every occasion market sentiment reaches severe levels—such as when the range of lengthy positions overwhelmingly exceed short positions and vice versa—then the vogue is viewed as exhausted and for that reason a fee reversal is imminent.

For instance, a dealer can region a buy order on a currency pair when developing pessimism has made its fee to plummet to extraordinarily low levels.

On the different hand, when the rate has multiplied to unsustainable tiers because of diminishing bullish pressure, the trader can area a promote order.

Contrarian merchants commonly go in opposition to the fundamental rule of trading: constantly trade according to the predominant trend. If the market has been strongly trending in a particular direction, contrarians trust that it is now time to reverse its move—and consequently will not vicinity trades in accordance to the trend.

However, when buying and selling the usage of this strategy, you should take into account that occasionally the market shows excessive conditions however continues with the main trend, barring any reversal in sight.

Therefore, you want to be disciplined and lift out a complete analysis of the market before using this strategy for trading.

Several technical contrarian indications are accessible for gauging the market sentiment. For example, a usual technical indicator that can perceive overbought and oversold market conditions is the Relative Strength Index (RSI).

The RSI contains of a single line, which fluctuates inside a scale of 0 to one hundred The scale is generally categorised as follows:

0 to 30: Oversold territory

30 to 70: Neutral territory

70 to 100: Overbought territory

As the RSI fluctuates between these regions, it assists merchants to pick out tops and bottoms in the market.

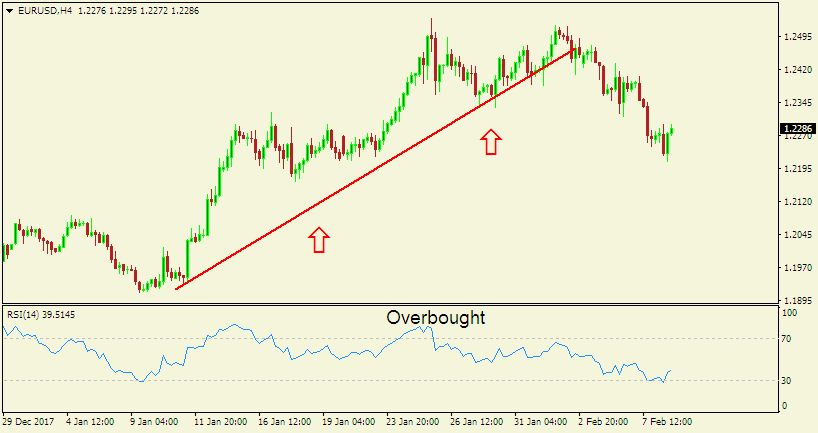

For example, here is a 4-hour chart of EUR/USD.

Forex Sentiment Analysis – 4-hour chart of EUR/USD

As seen on the chart above, EUR/USD was once strongly buying and selling upwards and the RSI studying used to be in most cases above the 70 mark.

Therefore, it signaled the diminishing shopping for stress in the market. Consequently, the pair then reversed its upward cross and began buying and selling downwards.

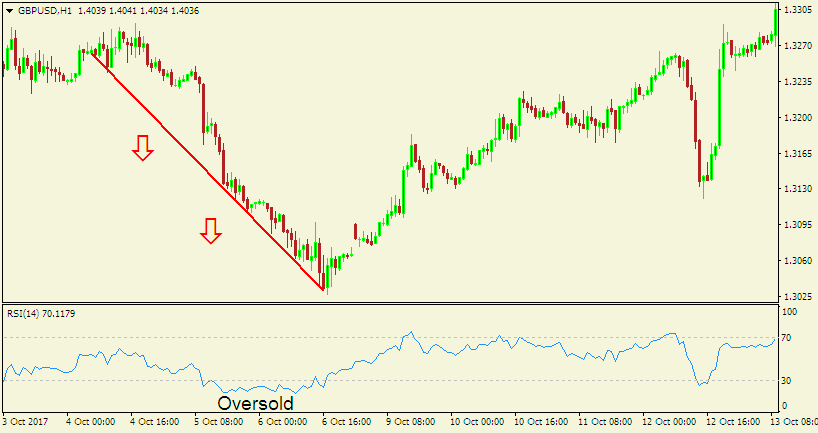

Here is any other instance of a 1-hour chart of GBP/USD.

Forex Sentiment Analysis – 1-hour chart of GBP/USD

As seen on the chart above, the currency pair was buying and selling downwards, and the RSI dropped under the 30 mark, indicating the lowering selling stress and an coming near near reversal.

Afterward, the price of the GBP/USD reversed upwards.

2. Commitment of Traders report

The Commitment of Traders (COT) record is furnished with the aid of the Commodity Futures Trading Commission (CFTC) each and every Friday. It is primarily based on the net lengthy and brief positions held with the aid of traders in the Chicago IMM trade as of the previous Tuesday.

Although the document is now not real-time, the data is nevertheless very treasured to help forex traders who favor to use it for gauging the prevailing market sentiment and taking intermediate and long-term positions.

To get entry to the report, click this link to CFTC’s website.

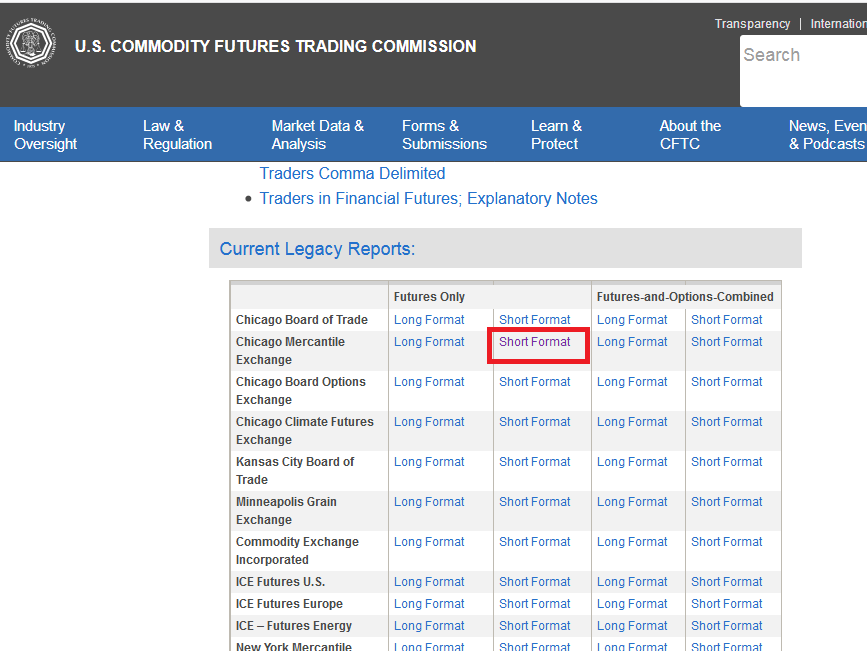

Then, scroll down to the “Current Legacy Reports” section, and click on “Short Format”, as highlighted below.

Forex Sentiment Analysis – CFTC’s website

You will then be directed to a report with a lot of information. To retrieve the specific statistics you want, simply do a search on the report.

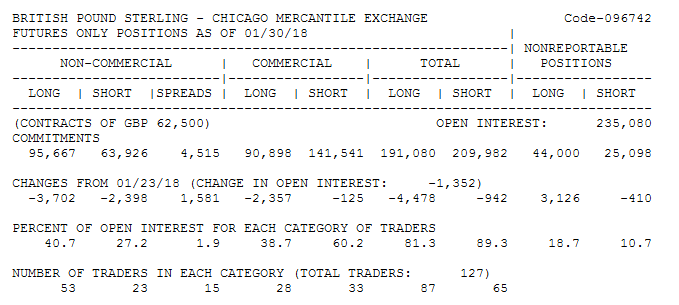

For example, right here is the data for the British pound.

Let’s explain the which means of the indispensable categories in the report.

Let’s explain the which means of the indispensable categories in the report.

Non-commercial: This class refers to a mixture of the positions held by way of person traders, hedge funds, and monetary corporations. They are in general interested in speculative gains.

Commercial: This refers to giant entities that depend on the futures market for hedging in opposition to investment uncertainties.

Nonreportable positions: This refers to the number of positions that are below the reporting requirements stipulated by the CFTC.

Long: This is the number of positions CFTC reviews to be buying futures contracts.

Short: This is the quantity of positions CFTC reports to be promoting futures contracts.

Open interest: This refers to the wide variety of unexercised or undelivered contracts.

Number of traders: This suggests the number of merchants required to inform the CTFC about their trades.

Understanding the COT report

The COT file gives positions taken with the aid of three types of traders: the business traders, the non-commercial traders, and the small traders.

The industrial merchants are hedgers who are commonly fascinated in defending their investments from market uncertainties. For example, economic establishments that intend to safeguard themselves from the surprising rise or fall of forex prices are viewed as industrial traders.

A imperative attribute of commercial traders is that they tend to embody a bullish stance at market bottoms and a bearish stance at market tops.

The non-commercial traders are the huge speculators who are interested in making earnings from the market. These traders can preserve massive accounts that can make the futures market to cross swiftly.

An indispensable characteristic of the non-commercial traders is that they are strong fashion followers. Thus, they tend to region buy orders when the market is trending upwards and sell orders when it is shifting downwards. The massive speculators will proceed putting greater trades until the market reverses.

Lastly, the small merchants are the hedge money and person traders running smaller retail buying and selling accounts. The small speculators are normally buying and selling barring considering the prevailing market trend.

Since retail traders frequently area anti-trend trades, they get fewer returns as compared to non-commercial or industrial traders. Nonetheless, when these small gamers want to enter trades in accordance to the trend, they often seem to be for market tops or bottoms.

How to use the COT file for trading

Because the COT file is launched weekly, its potential to gauge the market sentiment is necessary for making intermediate and long-term change decisions.

One method for using the record for buying and selling is to discover severe net long positions or extreme net short positions.

Spotting these positions ought to point out the weakening of the prevailing trend, and an drawing close market reversal.

To help you without problems interpret the COT record and perceive market sentiment extremes, you can use an indicator.

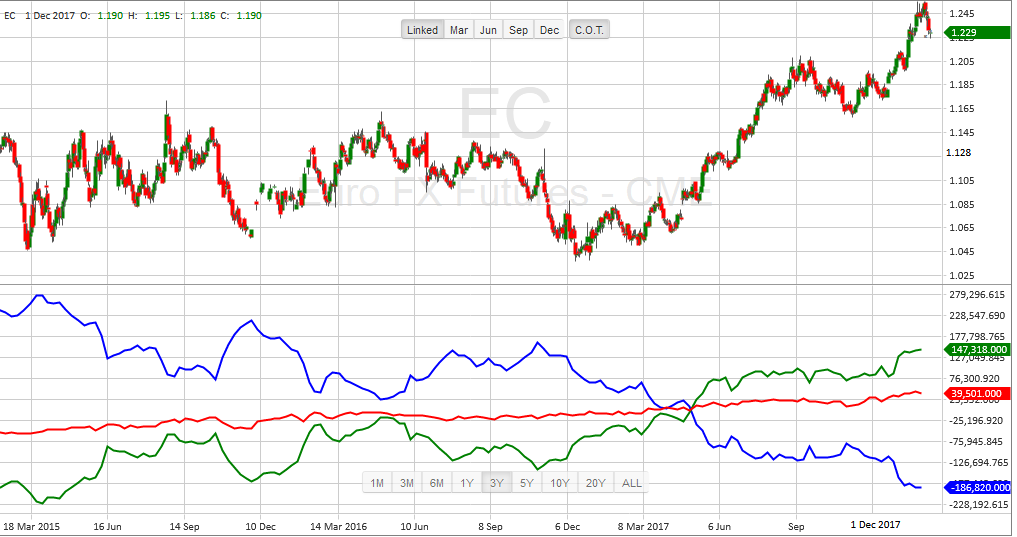

For example, right here is a 3-year chart from TimingCharts.com of Euro FX futures with a COT indicator applied.

The COT indicator has three lines: blue (commercial traders), inexperienced (non-commercial traders), and purple (retail traders).

Now, let’s ignore the other lines and focal point on the green one. As formerly mentioned, the non commercial traders are the huge speculators who vicinity positions in accordance to the dominant market trend.

Even even though these massive speculators have big account sizes, they cannot withstand experiencing losses for a lengthy time. Therefore, if an overwhelming wide variety of speculators are on the equal side, it is incredibly probably that a reversal will take place.

Let’s seem at what passed off round 6th December 2016 when the market was once trending downwards. The internet brief positions of the big speculators were at excessive levels, so did the fee of the currency.

Afterward, the market reversed and commenced trending upwards. If you could have used the COT indicator to spot the reversal, you could have booked lots of pips in the subsequent months.

Besides, you can also use the COT indicator to spot market tops and bottoms—since getting into trades when the sentiment is severe is generally extra profitable.

As you can see on the chart above, the green line (non-commercial traders) and the blue line (commercial traders) generally move oppositely.

Whereas the commercial merchants are bearish each time the market is trending upwards, the non commercial traders are bullish.

As such, the speculative positioning of non-commercial merchants can be used to discover the prevailing market trend. Likewise, the hedging positioning of business traders can be used to detect market reversals.

If commercial traders proceed placing buy orders whereas non commercial merchants continue setting promote orders, a market backside ought to ensue.

On the other hand, if business traders hold placing promote orders whereas non commercial traders proceed setting buy orders, a market pinnacle may want to ensue.

It’s now not easy to discover the specific vicinity the place extremes in market sentiment will take place. Thus, it’s prudent to wait for confirmations of the reversals before setting trades.