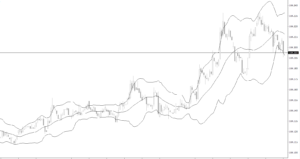

Bollinger Bands are a technical indicator developed by John Bollinger. The indicator forms a channel around the price movements of an asset. The channels are based on standard deviations and a moving average. Bollinger bands can help traders establish a trend’s direction, spot potential reversals and monitor volatility. All of this can help traders make better trading decisions if they follow a few simple guidelines.

Bollinger bands have three lines, an upper, middle and lower. The middle line is a moving average of prices; the parameters of the moving average are chosen by the trader. There is no magic moving average number, so the trader can set the moving average so it aligns with the techniques discussed below.

The upper and lower bands are drawn on either side of the moving average. The distance between the upper and lower band is determined by standard deviations. The trader determines how many standard deviations they want the indicator set at, although many uses two standard deviations from the average.

Uptrends with Bollinger Bands

Bollinger bands help assess how strongly an asset is rising (uptrend), and when the asset is potentially losing strength or reversing. This information can then be used to help make trading decisions. Here are three guidelines for using Bollinger Bands in an uptrend.

- When the price is in a strong uptrend it will typically touch or run along the upper band during impulse waves higher. When it fails to do that it shows the uptrend may be losing momentum.

- Even during an uptrend prices drop for periods of time, known as pullbacks. During an uptrend, if the price is moving strongly then pullback lows will typically occur near or above the moving average (middle) line. The pullback doesn’t have to stall out near the middle line, but it does show strength if it does.

- When the price is in a strong uptrend it shouldn’t touch the lower band. If it does that’s a warning sign of a reversal.

Downtrends with Bollinger Bands

Bollinger bands help assess how strongly an asset is falling (downtrend), and when the asset is potentially strengthening (to the upside) or reversing. This information can then be used to help make trading decisions. These three guidelines, similar to uptrend guidelines, can help use Bollinger Bands in a downtrend.

- When the price is in a strong downtrend it will typically touch or run along the lower band during impulse waves lower. When it fails to do that it shows the downtrend may be losing momentum.

- Even during a downtrend, prices may rally for periods of time, called pullbacks. During a downtrend, if the price is moving strongly lower then pullback highs will typically occur near or below the moving average (middle) line. The pullback doesn’t have to stall out near the middle line, but it does show selling strength if it does.

- When the price is in a strong downtrend it shouldn’t touch the upper band. If it does that’s a warning sign of a reversal.

Spotting Trend Reversals with Bollinger Bands

Using the trend guidelines, here are the summary guidelines for spotting reversals.

- If the price is in an uptrend, and continually hitting the upper band (and not the lower band), when the price hits the lower band it could signal that a reversal has commenced. If the price rallies again, it likely won’t be able to reach the upper band or the recent price high.

- If the price is in a downtrend and continually hitting the lower band (and not the upper band), when the price hits the upper band it could signal that a reversal has commenced. If the price declines again, it likely won’t be able to reach the lower band or the recent price low.

The first issue with Bollinger Bands is their limitation as just one indicator. John Bollinger recommends using them with two or three other un-correlated indicators, instead of seeing them as a stand-alone trading system.

With established guidelines on how to use the Bollinger Bands, find settings for the indicator that allow you to apply the guidelines to a particular asset you are day trading. Alter the settings so that when you look at historical charts you can see how the Bollinger Bands would have helped you.

If the Bollinger Bands don’t help you then change the settings or don’t use the bands to trade that particular asset. Ideal Bollinger Bands setting vary from market to market, and may even need to be altered over time even when trading the same instrument.

Once the indicator is set up and seemingly working well, the indicator may still tend to produce false signals. During low volatility times, the bands will contract, especially if the price is moving sideways. During such times the price may bounce off both the upper and lower band. In this case, it isn’t necessarily a reversal signal, though. The narrow bands are just closer to the price and thus likely to be touched.

Bollinger Bands aren’t a perfect indicator; they are a tool. They don’t produce reliable information all the time, and it’s up to the trader to apply band settings that work most of the time for the asset being traded.

The Bollinger Bands indicator is just a tool. It has flaws, and won’t produce reliable signals all the time. It can help you stay on the right side of trend and spot potential reversals, though. For that, you’ll need to set up the indicators so they align with the guidelines discussed above. Random or default setting on the indicator may not work well. Adjust the indicator and test it out with paper trades before using the indicator for live trades.