What are Heiken Ashi?

The Heiken Ashi indicator is an application that has gained in popularity recently after being relatively unknown. It was developed a few decades ago to improve upon the interpretation of Candlestick formations, which have been studied for centuries starting with rice merchants in Japan in the 1700s. Heiken Ashi is said to remove the “noise” from candlesticks and to behave much like a moving average. Traders use Heiken Ashi to determine the relative strength of a trend and to pinpoint key turning points in price behavior.

The Heiken Ashi application tool takes the basic candlestick information, the open, close, high, and low, and then “smoothes” the erratic portions of the chart in much the same fashion as would a moving average. Traders can then make a better-informed decision without the distractions caused by volatile price action.

Heiken Ashi Formula

The Heiken Ashi indicator is common on Metatrader4 trading software, and the calculation formula smoothes pricing information by averaging as follows:

- Close = (Open Price + High + Low +Close) / 4

- Open = (Average of Open Price and Close Price of the previous bar)

- High = (Maximum value of the (High, Open, Close))

- Low = (Minimum value of the (Low, Open, Close))

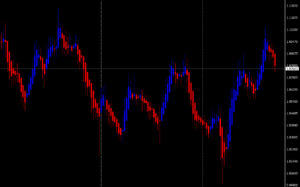

Software programs perform the necessary computational work, and the Heiken Ashi tool produces a more visually appealing chart as displayed below: