Parabolic SAR is developed by Welles Wilder and first presented in his 1978 book titled New Concepts in Technical Trading Systems. Initially, Wilder named the indicator Parabolic Time/Price System but later reverted to Parabolic SAR. The name refers to the basic behavior of the indicator when integrated on a price chart. The SAR stands for “stop and reverse,” which is the behavior of the indicator.

Similar to all technical indicators, Parabolic SAR trails the underlying asset based on time and price. This indicator trails price action throughout its course along a time scale. The indicator appears as a dot on a price chart where it appears on the top side of price action if the price is bearish, but it stops and reverses to the lower side of the price chart when the price action turns bullish.

Because of the reversing behavior, Parabolic SAR is useful when traders want to determine the direction of a trend and when the trend is about to reverse. As such, the indicator is suitable for determining the best time to enter or exit the market for maximum returns.

Parabolic SAR behaves like a trailing stop, where it follows the market trend, and it reverses when the price action reverses. In an uptrend, SAR rises continuously for as long as the trend stays in that trajectory. Looking at it from another perspective, the SAR remains upward-facing, and it continually defends the profits of a position as price action advances. In other words, Parabolic SAR could be a useful indicator of a trailing stop loss. The same is true in a downtrend where it continuously protects traders’ profits on short positions.

Furthermore, the indicator is useful as a signal to buy or sell. When to buy and when to sell are the two most important decisions a forex trader has to make regardless of the work put into strategizing. After all, a strategy is only as good as the returns it gives. If it leads to losses or less than par profits, then it was not good at all. It is why expert traders always know that the position entry and exit decisions are the key part of a trading strategy.

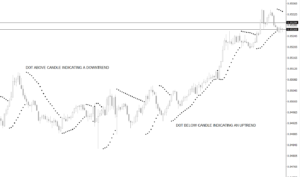

The ability of Parabolic SAR to point traders in the right direction in terms of trade timing makes it one of the most critical in the market. As earlier discussed, the dots (which form the parabolic line) take a position based on price action nature. If the market’s selling pressure is greater than the buying pressure, the parabolic line takes a position on the upper side of the price chart. When the trend shifts and now the bulls outweigh the bears, the dots shift position and appear on the price chart’s underside.

The most apparent advantage of SAR is simplicity. By just looking at the dots’ position on the price chart, a trader can forecast the direction of price action. Moreover, the indicator trails the price at a safe distance, meaning traders can use it as a trailing stop to maximize profits.

On the downside, Parabolic SAR could be misleading in some situations, especially in a sideways market. As shown in the chart above, the indicator could signal a trend reversal even when the market lacks the strength to follow. For this reason, always use an additional indicator to confirm the signal that SAR gives.