Defining Correlation

The motive for the interdependence of currency pairs is easy to see: If you are trading the British pound in opposition to the Japanese yen (GBP/JPY pair), for example, you are truly buying and selling a derivative of the GBP/USD and USD/JPY pairs; therefore, GBP/JPY have to be really correlated to one if not both of these different forex pairs. However, the interdependence among currencies stems from greater than the simple truth that they are in pairs. While some forex pairs will pass in tandem, other currency pairs may additionally move in contrary directions which is the result of extra complex forces.

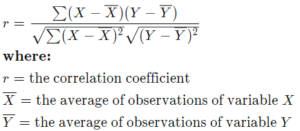

Correlation, in the economic world, is the statistical measure of the relationship between two securities. The correlation coefficient ranges between -1.0 and +1.0. A correlation of +1 implies that the two foreign money pairs will pass in the same path a hundred percent of the time. A correlation of -1 implies the two foreign money pairs will cross in the opposite path one hundred percent of the time. A correlation of zero implies that the relationship between the foreign money pairs is completely random.

The formula is;

How to Use Correlations to Trade Forex

Now that you know how to calculate correlations, it is time to go over how to use them to your advantage.

First, they can help you keep away from coming into two positions that cancel every different out, For instance, by way of understanding that EUR/USD and USD/CHF go in contrary instructions almost one hundred percent of time, you would see that having a portfolio of long EUR/USD and long USD/CHF is the equal as having surely no role because, as the correlation indicates, when the EUR/USD rallies, USD/CHF will bear a selloff. On the other hand, keeping lengthy EUR/USD and lengthy AUD/USD or NZD/USD is comparable to doubling up on the same position on account that the correlations are so strong.

Diversification is some other factor to consider. Since the EUR/USD and AUD/USD correlation is traditionally now not 100% positive, traders can use these two pairs to diversify their hazard extremely while still retaining a core directional view. For example, to specific a bearish outlook on the USD, the trader, as a substitute of shopping for two loads of the EUR/USD, may additionally buy one lot of the EUR/USD and one lot of the AUD/USD. The imperfect correlation between the two one of a kind currency pairs permits for extra diversification and marginally lower risk. Furthermore, the central banks of Australia and Europe have one of a kind economic coverage biases, so in the match of a dollar rally, the Australian dollar may also be much less affected than the euro, or vice versa.

A trader can use also specific pip or point values for his or her advantage. Let’s consider the EUR/USD and USD/CHF as soon as again. They have a near-perfect negative correlation, but the value of a pip move in the EUR/USD is $10 for a lot of 100,000 units while the cost of a pip cross in USD/CHF is $9.24 for the same quantity of units. This implies traders can use USD/CHF to hedge EUR/USD exposure.

Here’s how the hedge would work: Say a trader had a portfolio of one brief EUR/USD lot of 100,000 devices and one brief USD/CHF lot of 100,000 units. When the EUR/USD increases by 10 pips or points, the trader would be down $100 on the position. However, due to the fact that USD/CHF strikes opposite to the EUR/USD, the short USD/CHF role would be profitable, likely shifting close to ten pips higher, up to $92.40. This would flip the net loss of the portfolio into -$7.60 alternatively of -$100. Of course, this hedge additionally ability smaller income in the event of a robust EUR/USD sell-off, however in the worst-case scenario, losses become incredibly lower.

Regardless of whether or not you are looking to diversify your positions or discover alternate pairs to leverage your view, it is very vital to be aware of the correlation between various currency pairs and their transferring trends. This is powerful information for all professional traders holding greater than one currency pair in their trading accounts. Such know-how helps traders diversify, hedge, or double up on profits.