All Contents

Contents

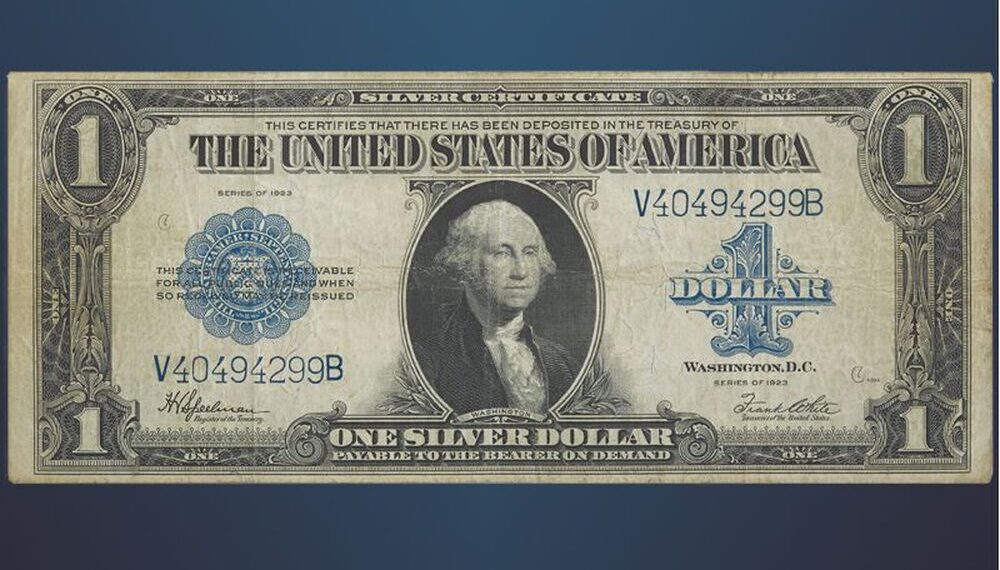

What Is a Silver Certificate? A silver certificate is a type of legal tender in the form of paper currency that was issued by the U.S. government beginning in 1878. These certificates were eventually phased out in 1964 and today can be redeemed for their face value in cash only,

To calculate the gains or losses on a stock investment, one must first know the cost basis, which is the purchase price initially paid for the stock. Investors who neglected to record this information may find it on the order execution confirmation form or the brokerage account statement from the

The distinction between stocks and shares in the financial markets is blurry. Generally, in American English, both words are used interchangeably to refer to financial equities, specifically, securities that denote ownership in a public company. Nowadays, the difference between the two words has more to do with syntax and is

Stock markets and major commodities such as oil and gold seem to get most of the mainstream financial market headlines these days. Despite being the largest and most liquid trading markets in the world, the global currency markets do not get nearly the same attention. There are a few key

Forex sentiment refers to the typical feeling the market members have about the overall performance of a forex pair. It is a useful way of gauging the feeling or tone of the market and then making fabulous alternate decisions. Every trader taking part in the forex market has his or her personal opinion about the direction the market is likely to take. And, the selections they make—whether to vicinity purchase or promote orders—is based totally on these views. Ultimately, the predominant path the market is

To better understand the forex spread and how it affects you, you must understand the general structure of any forex trade. One way of looking at the trade structure is that all trades are conducted through intermediaries who charge for their services. This charge which is the trade’s difference between the bidding

The foreign exchange (forex) market is huge, with an average daily trading volume of more than $5 trillion, including currency futures and options. It’s also not very well regulated. That means the opportunity still exists for many forex scams that promise quick fortunes through “secret trading formulas,” algorithm-based “proprietary” trading methodologies,

In the UK, the spread betting sector is mainly controlled by the Financial Conduct Authority (FCA). Betting companies are spread internationally through the FCA and licenses. Moreover, it prosecutes businesses or persons engaged in deceptive or unjust commercial or trade practices. The FCA provides stringent supervision and control of investment

New spread bettors are susceptible to make a few very common errors in spread betting. Of course, from time to time, every trader makes mistakes, but new traders naturally appear to make more. This is particularly troublesome because new spread bettors are likely to have much less ability: -To tolerate

Spread Starting forex trading has never been easier. Now there are more and more top forex brokers offering great deals, powerful educational infrastructures, and more to attract your business. This is great for you as a potential forex trader, so long as you know some key points about trading forex.

Recent Posts

Recent Comments

- Cacey Taylor on Forex vs Stock Trading

- A WordPress Commenter on Hello world!

- John Doe on Which is the Best PC for Photo Editing?

- John Doe on Giant Cruise Ships

- John Doe on 50 Most Beautiful Places in the World

Categories

- Articles/FAQ

- Blockchain

- Cash/Voucher/Card based

- Commodity

- Credit Card

- Cryptocurrency

- cyber security

- Digitization

- e-Payment

- e-Wallet

- Fintech

- Forex

- Fraud

- hacking

- High risk

- Investment

- Mobile Payment

- News

- Payment Gateway

- Scam

- Security

- Shipping Methods

- Stock

- Technology

- Travel

- Troubleshooting

- Uncategorized

Latest Posts

- January 22, 2021

- January 22, 2021

- January 22, 2021

- January 12, 2021

- January 12, 2021

Newsletter